Train Now. Pay over time.

We’ve partnered with ShopPay and Affirm to offer flexible financing options. Now, you can train your way and pay on a schedule that works for you.

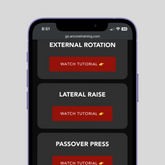

How to Pay with Shoppay

Add your items to your cart.

Check out with ShopPay.

Choose the option to pay in installments.

How to Pay with Affirm

Select Affirm at checkout, then enter a few pieces of info for a real-time decision.

Pick the plan that fits your budget. You'll never pay late or hidden fees.

Make payments at affirm.com or in the Affirm app. You’ll also get reminders by text and email

When checking out with Shop Pay, you have the option to pay now or later. Paying in installments on Shop Pay allows you to split your purchase amount into four equal, biweekly installment payments with 0% APR (United States and Canada), or monthly installments with no hidden or late fees (United States, Canada, and United Kingdom).

Debit cards are accepted as a payment method for Shop Pay Installments orders in all countries. In some countries, credit cards might also be an available payment method for certain Shop Pay Installments orders.

Shop Pay Installments is available only to customers who reside in the United States, Canada, or the United Kingdom that have a United States, Canadian, or United Kingdom mobile phone number, and use a payment card with a United States, Canadian, or United Kingdom billing address.

Yes. In the United States and Canada, $30,000 USD or CAD is the order value limit that applies to purchases using Shop Pay Installments, including discounts, shipping, and taxes. In the United Kingdom, the order value limit is £30,000 GBP including discounts, shipping, and taxes.

No. An application for Shop Pay Installments can only begin with a live checkout. Applying in store only takes a few steps and you’ll get a real-time decision in minutes.

You can't purchase gift cards using Shop Pay Installments. If you want to purchase gift cards along with Shop Pay Installments eligible products, then you need to place two separate orders.

No, there are no late fees if you miss a scheduled payment.

There are no late fees for customers who miss a scheduled payment. However, partial payments or late payments might impact your credit score, or your eligibility to use Shop Pay Installments in the future.

If you have questions about a missed installment payment, then visit Affirm’s Shop Pay Installments Help Center for customers in Canada, the United States, or the United Kingdom.

To request a refund, contact the store where you purchased your item. Using their return policy, the store will advise if a return is possible. If a return is possible, then the store will advise how much the refunded amount will be. After your refund is processed, the refund amount will be applied to your original payment method within 3-10 business days and your balance will be updated.

If your refund is less than your total purchase balance, then it might not lower your next payment. Instead, you can expect fewer payments, a smaller final payment, or both.

If your refund is more than your purchase balance, then the difference is returned to your original payment method within 3-10 business days.

If your order is made with interest payments, then the paid interest isn't refunded. When you make payments, the funds are first applied to the accrued unpaid interest and then to the principal. Interest is the cost of borrowing, and isn't refundable.

Yes! There’s no penalty for paying early.

Transparent - You’ll never pay late fees, hidden fees, or annual fees. And never any compound interest, either.

Flexible - You choose the payment schedule that works best for you.

Fair - Affirm doesn’t charge late fees or hidden fees of any kind, ever.

You can learn more about how Affirm works on there website.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or

Android. Affirm will send you email and text reminders before payments are due

Yes—you can return an item you bought with Affirm by initiating the return process

with the store.

No, your credit won't be affected when you create an Affirm account or check your

eligibility (including checking your pre qualification eligibility). When you apply for or check to see if you prequalify for Affirm financing, it's considered a soft inquiry,

which does not affect your credit. If you decide to pay with installments through

Affirm, your payment plan and repayment activity may be reported to credit

bureaus.

You can find more information on Affirm's Help Center.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps

Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com.

Shoppay and Affirm Disclosures

Rates from 0-36% APR. Payment options through Shop Pay Installments are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. State notices to consumers: affirm.com/licenses.

Rates from 0-31.99% APR (subject to provincial regulatory limitations). Payment options through Affirm Canada Holdings Ltd. ("Affirm") are subject to an eligibility check and depend on purchase amount, payment terms, vary by merchant, and may not be available in all provinces/territories. Minimum purchase and down payment may be required. For example, an $800 purchase could be 12 monthly payments of $72.21 at 15% APR for total repayment of $866.48 (credit charges of $66.48), or 4 interest-free payments of $200 every 2 weeks. Visit helpcenter.affirm.ca for more information.

Rates from 0–36% APR. Payment options through Affirm are subject to an eligibilitycheck, may not be available everywhere, and are provided by these lending partners:affirm.com/lenders. Options depend on your purchase amount, and a down paymentmay be required. CA residents: Loans by Affirm Loan Services, LLC are made orarranged pursuant to a California Financing Law license. For licenses and disclosures,see affirm.com/licenses